Transfer Pricing in Thailand 泰國移轉對價介紹

Transfer pricing represents the price that relevant parties[1] transact with each other for goods and services provided. It allows the establishment of prices for goods and services exchanged between a subsidiary or commonly controlled companies which are part of the same corporation. Transfer pricing can make tax savings for corporations, although tax authorities may debate the claims.

移轉對價表示雙方就所提供的商品和服務進行交易的價格,它允許子公司或同一公司相關企業建立交易商品和服務的價格。移轉對價可為公司節稅,但稅務單位可對節稅一事進行調查確認。

In November 21, 2018, the Thai Revenue Department (“TRD”) announced the Revenue Code Amendment Act No. 49 B.E. 2561 (2018), namely, the transfer pricing (“TP”) Law, and has been effective for the accounting period starting from 1 January 2019 onwards. In November 2019, for evaluation of transfer pricing exposure at the level of each taxpayer, the TRD issued rules based on section 71 Ter[2] of the TP Law, requiring relevant parties to report transactions in a form. The disclosure form must be summated within 150 days from the end of 2019 accounting period. Furthermore, transfer pricing documents need to be submitted within 60 days of a request (some extension may be possible).

泰國稅務局(簡稱“ TRD”)於2018年11月21日頒布佛曆2561年(2018年)第49號《泰國稅法修訂案》,即移轉對價《TP》法,於2019年1月1日起生效。為了評估每個納稅人的移轉對價風險,TRD根據《TP法》第71條之3發布一項規定,要求交易雙方將交易內容填寫在表格內,此表必須在2019會計年度結束後150天內進行匯總。此外,移轉對價文件需在申請後的60天內提交(有些可以延期)。

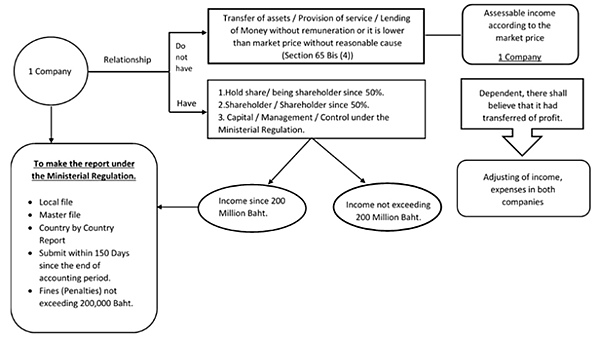

Only taxpayers with annual income less than 200 billion baht are exempted from the requirement above. In addition, if taxpayers haven’t complied with the disclosure form and transfer pricing documents requirements, there is a fine up to 200,000 baht.

只有年收入低於2,000億泰銖的納稅人才免除上述要求。另外,如果納稅人不遵守接露表和移轉對價文件的要求,會被處以最高20萬泰銖的罰款。

Following is flowchart for your better understanding:[3]

以下為泰國移轉對價的流程圖:

[1] According to section 71 Bis of TP Law, the relevant parities can be defined as “An entity holds shares or is a partner of the other entity, either directly or indirectly, not less than 50 percent of the other entity’s total capital”

[2] The company or juristic partnership having mutual relationships with other company or juristic partnership where they are fallen into any characteristic in pursuance of Paragraph two of Section 71 Bis, whether or not there are relationships throughout an accounting period or mutual transactions in the accounting period, shall submit the document with regard to information of the companies or juristic partnerships having mutual relationship and the values of mutual transactions in each accounting period according to the form as specified by the Director-General to an assessment officer, together with the tax return, within the period under Section 69.

留言列表

留言列表

{{ article.title }}

{{ article.title }}